What Are Trust Administration Services?

Vermillion Law offers trust administration services. Learn what that means and how to evaluate a good candidate for this important role.

Various Gift and Death Taxes Everyone Should Know About

The way you manage money during your lifetime can affect taxes that arise upon your death. Some of the first steps to knowing how to minimize or eliminate taxes are understanding how they apply to you and how you can take advantage of the IRS tax code. Here are some basics:

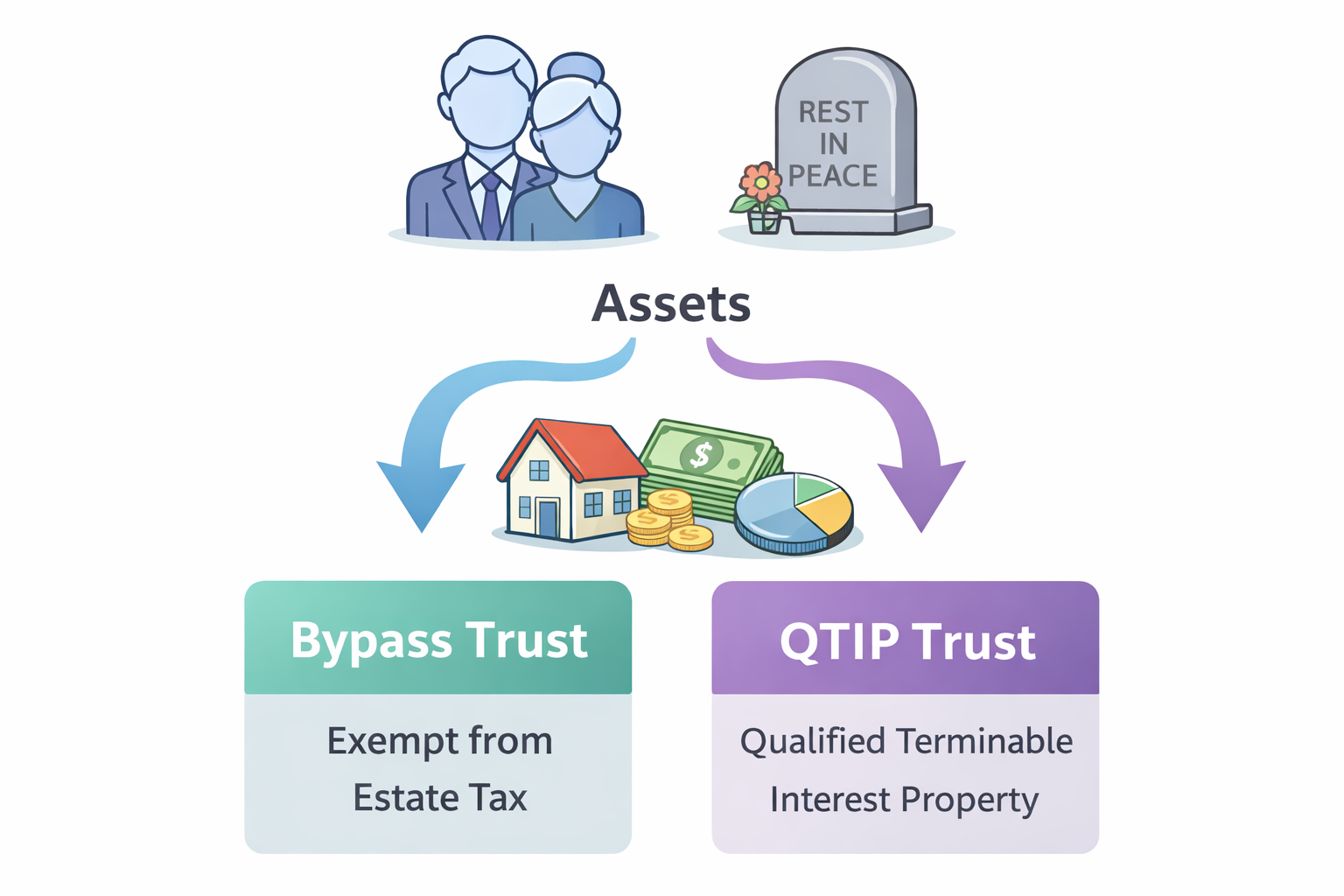

Benefits to Using a Bypass and QTIP trust Versus Utilizing DSUE Only

Estate planning strategies that experienced attorneys use could benefit you and your family tremendously. Learn about how Bypass and QTIP Trusts might be superior to the IRS’s DSUE…

Why Do We Have a Bypass and QTIP Trust in Our Revocable Living Trust?

Not every revocable living trust has a Bypass and QTiP trust in it, but if it does, here’s why…

What Happens to My House If My Spouse or I have to Go Into Assisted Living?

What happens to your house if you and/or your spouse have to go into assisted living permanently? Learn about Medicaid Asset Protection Strategies. . .

Franchise & Excise Taxes in TN, How to File the Return and Other Great Info

If you own an entity that operates in Tennessee, you’re probably subject to required Franchise and Excise Taxes. Check out the great resources made available here through the TN Department of Revenue.

Categories

Tags

- Estate Planning

- Revocable Living Trust

- Asset Protection

- Business Law

- Business Taxes

- Probate

- Business Formation

- Tennessee Business Law

- Tennessee Estate Planning

- LLC

- Will

- Franchise and Excise Tax

- Beneficiary Deeds

- DIY Estate Planning

- Federal Estate Taxes

- Guardianship

- Transfer on Death Deed

- General Durable Power of Attorney

- F&E Tax

- Medicaid Planning

- Revocable Trust

- Last Will and Testament

- IRS

- Federal Tax Exclusion

- PLLC