Benefits to Using a Bypass and QTIP trust Versus Utilizing DSUE Only

DSUE, or Deceased Spousal Unused Exclusion, is an IRS rule that lets a surviving spouse use any unused portion of the federal estate tax exemption of the first spouse to die. In 2025 that exclusion amount was $13.99 million per person, but as the tax code changes, so will that number, and it will likely decrease significantly in the coming years.

If all assets are left to the surviving spouse, the first spouse may not need their exemption, and that unused federal estate tax exemption amount can be transferred to the survivor by filing a timely estate tax return. This gives the surviving spouse a larger exemption when they later die, which can reduce or eliminate estate taxes, but it only preserves the exemption amount, not any future growth of the assets. This can be used in place of a Bypass and QTIP trusts, but it doesn’t include all of the benefits of a Bypass trust and QTIP trust.

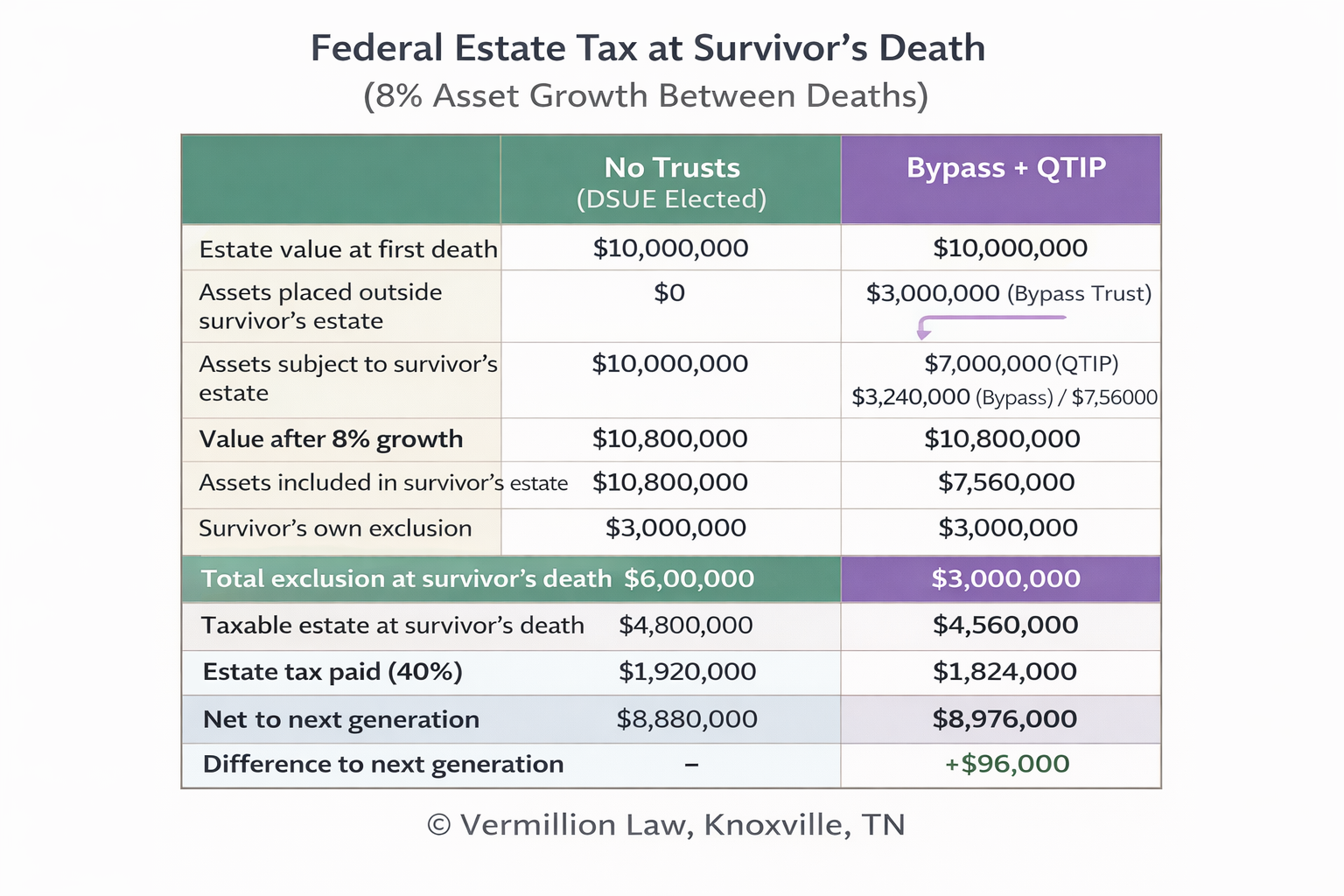

Here’s an illustration showing the benefits to using a Bypass and QTIP trust versus using the DSUE:

Key Assumptions

· Estate at first death: $10,000,000

· Federal exclusion: $3,000,000 per person

· Estate tax rate: 40%

· One-time 8% growth between first and second death (for illustration)

· DSUE elected where applicable

With just 8% growth, the Bypass + QTIP structure delivers $96,000 more to the next generation than relying on DSUE alone. As growth rates increase or time horizons lengthen, this advantage compounds rapidly, which is why Bypass trusts remain a core planning tool even in a portability environment.

Other Benefits to Using Bypass and QTIP Trusts Versus DSUE

Guaranteed use of both spouses’ estate tax exclusions

Ensures the first spouse’s exclusion is fully used and not lost due to oversight, remarriage, or changes in the law.

Control over final beneficiaries

Allows the first spouse or spouses acting together to determine who ultimately receives the assets (for example, children or grandchildren), even though the surviving spouse benefits during life.

Protection in blended family situations

Prevents assets from being redirected to a new spouse or that new spouse’s family after remarriage.

Creditor protection for the surviving spouse

Trust assets are generally shielded from the surviving spouse’s creditors, lawsuits, and bankruptcy claims.

Protection against incapacity

If the surviving spouse becomes incapacitated, trust assets continue to be managed by a trustee without court involvement.

Insulation from future tax law changes

Locks in the first spouse’s exclusion permanently, regardless of future reductions or elimination of portability (DSUE).

Avoidance of DSUE administrative risk

Eliminates reliance on timely filing of estate tax returns and ongoing portability compliance.

State estate tax planning

Many states do not recognize DSUE; Bypass trusts can minimize or eliminate state-level estate taxes.

Preservation of family wealth discipline

Allows assets to be distributed under structured terms rather than outright, reducing the risk of mismanagement.

Predictability and certainty

Provides a known, durable outcome that does not depend on survivor decisions, remarriage, or later planning changes.

If you’d like to learn more about trust-based planning, sign up for one of our free in-person seminars that are held in East Tennessee each week: Click HERE to sign up.